Fraud is one of the most persistent and evolving challenges in the financial services industry. With the growing reliance on digital transactions, online banking, and electronic payments, fraudsters are employing increasingly sophisticated methods. Traditional fraud detection systems, often rule-based and static, struggle to keep pace with these advanced threats. Artificial Intelligence (AI) has emerged as a transformative solution, offering real-time, scalable, and adaptive fraud detection mechanisms that are revolutionizing how financial institutions protect themselves and their customers.

AI enables institutions to detect and prevent fraud with greater accuracy, speed, and efficiency by analyzing vast datasets, identifying unusual patterns, and predicting fraudulent behaviors before they occur. This has not only minimized losses but also enhanced customer trust and satisfaction.

The Expanding Scope of Fraud in Financial Services

The digital revolution has created new vulnerabilities for financial institutions. Common types of financial fraud include:

Credit card fraud, where unauthorized transactions are carried out using stolen or counterfeit cards.

Identity theft, where fraudsters use stolen personal information to access accounts or apply for credit.

Account takeovers, where attackers gain unauthorized access to user accounts through phishing or hacking.

Money laundering, where illegal money is disguised as legitimate through complex financial transactions.

Insurance fraud, involving false claims or exaggerated damages to receive payouts.

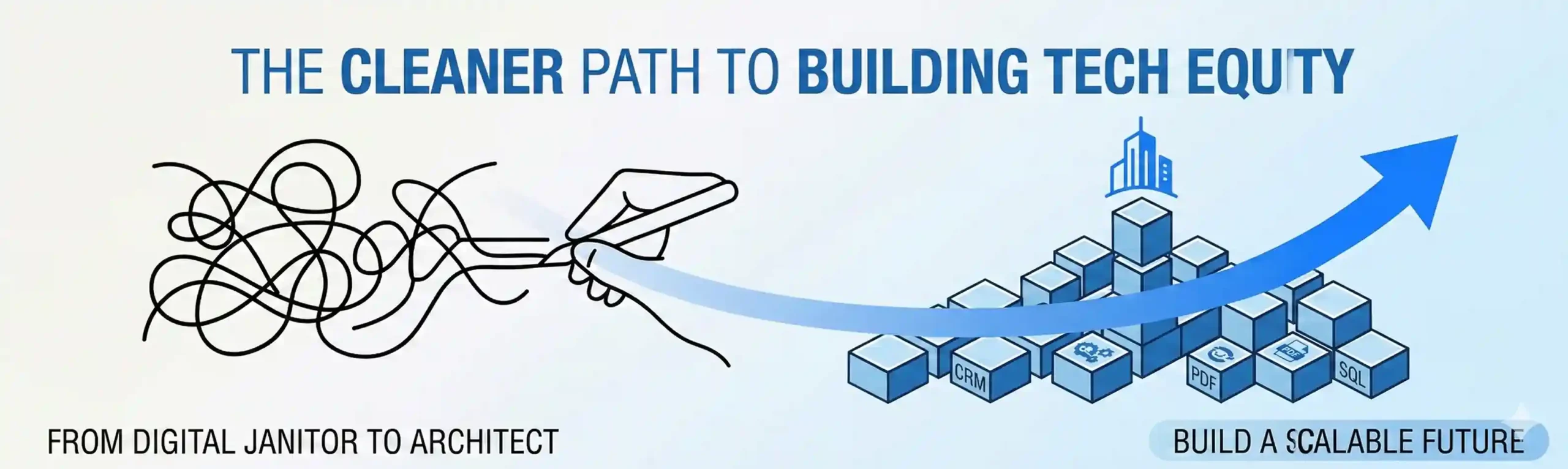

Traditional fraud detection methods, relying on fixed rules and manual reviews, often fall short due to their inability to adapt to the rapidly changing tactics of fraudsters.

How AI Enhances Fraud Detection

AI transforms fraud detection by automating processes, improving accuracy, and providing real-time solutions. Here are the key ways in which AI revolutionizes fraud prevention:

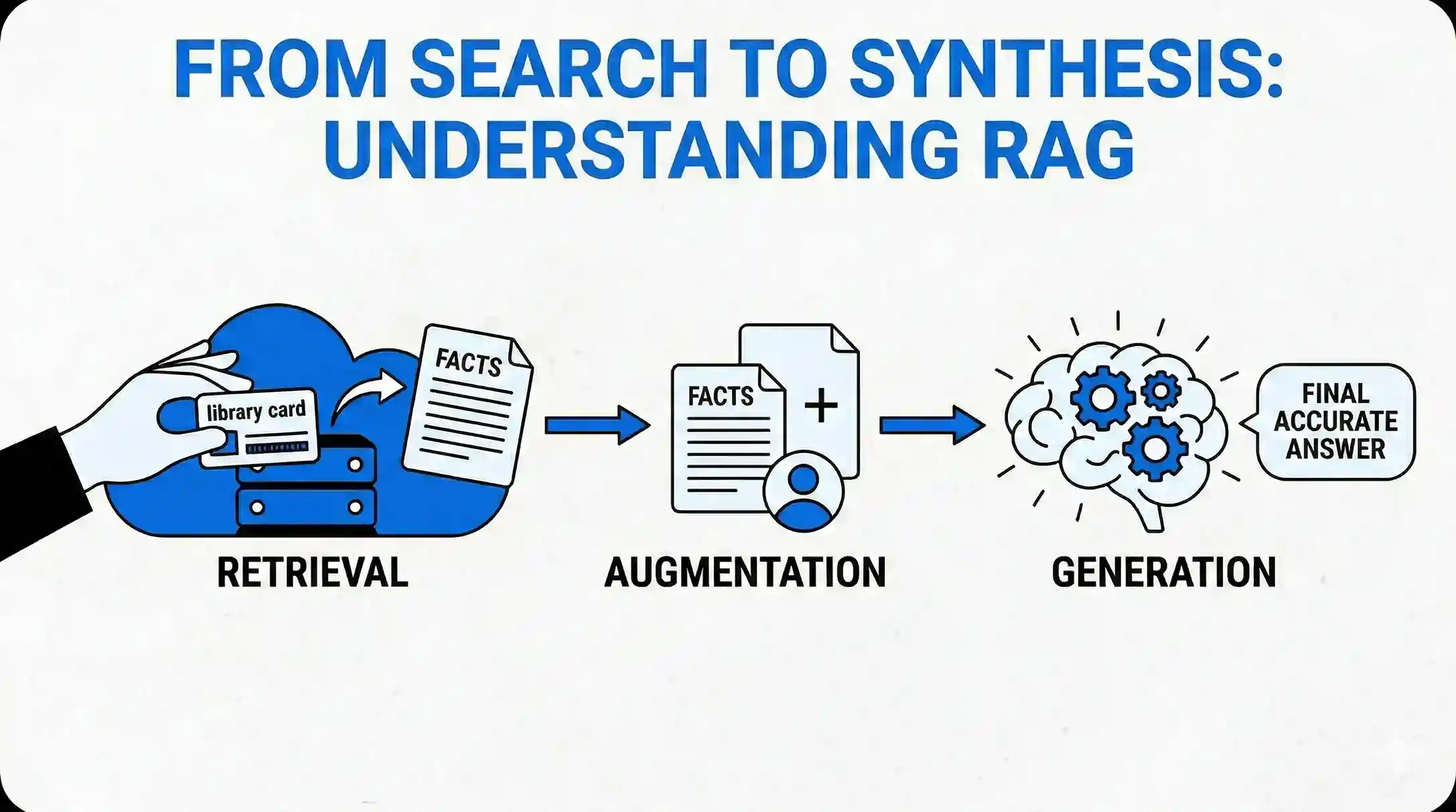

Anomaly detection systems analyze vast transaction datasets to identify deviations from normal behavior. For example, an unusual transaction amount or location might be flagged for further review.

Real-time monitoring enables AI to process and evaluate transactions instantly, preventing fraudulent activities before they are completed.

Behavioral analytics track user habits such as login times, device usage, and spending patterns. Any deviation from these established behaviors triggers an alert, even if the transaction details appear legitimate.

Pattern recognition uses machine learning algorithms to study historical data and identify patterns indicative of fraudulent activities. These patterns are then used to predict and prevent similar behaviors in the future.

Risk scoring evaluates the likelihood of a transaction being fraudulent based on multiple factors, such as location, device type, and customer history. High-risk transactions are flagged for manual review or blocked automatically.

Natural language processing (NLP) analyzes text-based data, such as emails, customer complaints, or insurance claims, to detect inconsistencies or potential red flags.

Applications of AI in Fraud Detection Across Financial Services

The versatility of AI makes it applicable to multiple areas of fraud detection, including:

Credit card fraud detection, where AI models analyze real-time transaction data, identifying anomalies that may indicate fraudulent activities. For example, a sudden high-value purchase in a foreign location can trigger an alert.

Identity verification systems powered by AI use biometric data, such as facial recognition or fingerprint scanning, to confirm user identities, preventing unauthorized access.

Anti-money laundering (AML) solutions leverage AI to detect unusual transaction patterns, such as frequent small deposits followed by a large withdrawal, a common tactic in money laundering schemes.

Insurance fraud detection is enhanced by AI analyzing claims data, looking for inconsistencies or repeated claims patterns that might indicate fraudulent activity.

Trade and investment fraud detection uses AI to monitor trading activities and identify market manipulation tactics, such as pump-and-dump schemes or insider trading.

Benefits of AI in Financial Fraud Detection

AI brings numerous advantages to the financial sector, including:

Improved accuracy by reducing false positives, ensuring that legitimate transactions are processed without unnecessary disruptions.

Faster detection and response capabilities, allowing financial institutions to act immediately against potential fraud.

Adaptability to evolving fraud tactics, as machine learning models continuously improve and learn from new patterns.

Cost efficiency by automating processes, reducing the need for extensive manual reviews and investigations.

Enhanced customer experiences by minimizing disruptions for genuine users while maintaining robust security measures.

Compliance support through automated reporting and detailed audit trails, helping institutions meet regulatory requirements.

Challenges in Implementing AI for Fraud Detection

Despite its benefits, implementing AI for fraud detection is not without challenges:

High initial costs associated with developing and deploying AI systems, including investments in infrastructure, software, and training.

The need for high-quality data, as AI systems rely on accurate and diverse datasets to function effectively. Poor data quality can compromise the results.

Integration complexity, as AI tools must work seamlessly with existing systems and workflows, which can be technically challenging.

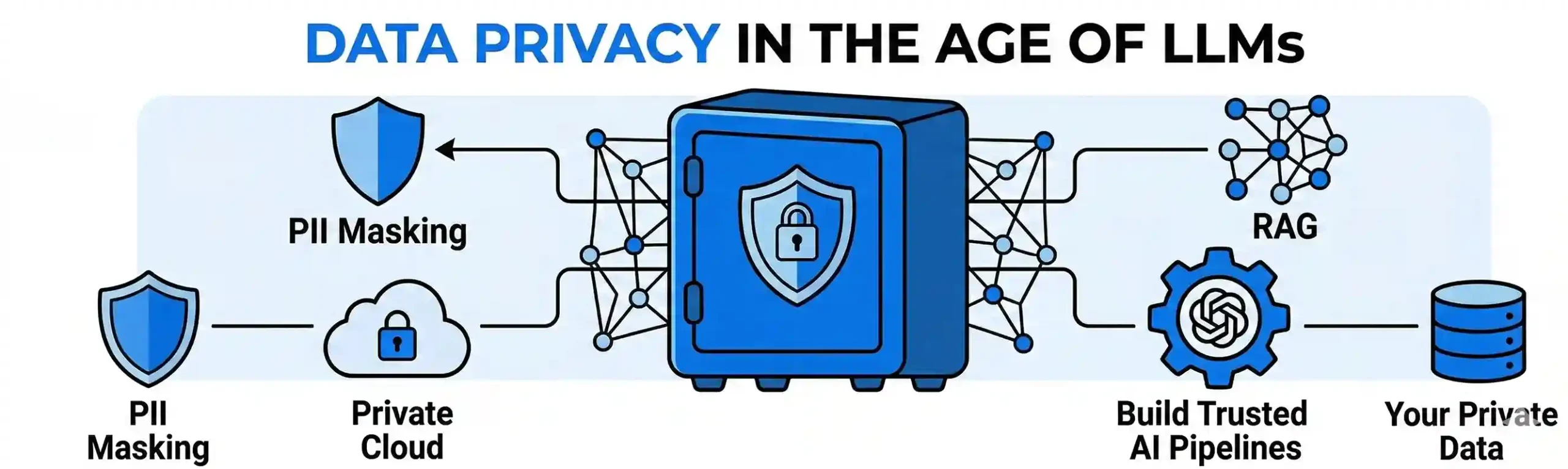

Data privacy and ethical concerns, particularly with regulations like GDPR and CCPA, requiring institutions to handle customer data with utmost care.

Algorithmic bias risks, where models trained on biased datasets may produce unfair or inaccurate outcomes, necessitating regular audits and updates.

The Future of AI in Fraud Detection

The role of AI in fraud detection is expected to grow exponentially as technology continues to evolve. Key trends include:

Federated learning, which enables multiple financial institutions to share insights without compromising data privacy, enhancing collaborative fraud detection.

Advanced behavioral biometrics, which track micro-behaviors such as typing speed or mouse movements, offering an additional layer of security.

Explainable AI (XAI) systems, which provide transparent explanations for decisions, helping institutions meet regulatory requirements and build trust with customers.

AI-powered collaboration networks that connect institutions, enabling them to identify and respond to emerging fraud trends collectively.

AI is not just a tool but a necessity in the fight against financial fraud. By adopting AI-driven fraud detection systems, financial institutions can protect their assets, build customer trust, and stay ahead of ever-evolving threats. In an era where fraud tactics are becoming increasingly sophisticated, AI offers the precision, scalability, and adaptability needed to safeguard the financial ecosystem.